Structural reforms: what’s in a name?

Economy 1 December 2014In August this year, Mario Draghi speaking at the Annual Central Bank symposium suggested that the way out of the crisis in which the EU – and most notably the Eurozone – is trapped, should be composed of a mix of three policies: monetary policies, fiscal policies and structural reforms. The words of Draghi echoed the “three arrows” strategy of Shinzo Abe – Japan’s Prime Minister – and marked a decisive step forward in the EU economic policy strategy, so far largely based on fiscal consolidation. In this and the following article we shall look in some detail at this policy mix, starting with structural reforms.

The term “structural reform” is abundantly used in International Institutions’ economic papers. The OECD’s Going for Growth and the European Commission’s Annual Growth Survey contain ample references to structural reforms and DG ECFIN carries out specific surveillance exercises to assess their implementation. Yet, surprisingly, it is extremely hard to find a definition of what exactly structural reforms are. And not just on the papers of these institutions: try asking Google!

Structural reforms, in their tautological definition, mean reforms that change the structure of the economy. Some papers argue that structural reforms are about “using productive factors as efficiently as possible”. Other sources link the term to the reforms undertaken by countries that went through “structural adjustment programmes” of the IMF. Finally some rather disenchanted commentators simply put it as “structural reforms mean a lot of things to a lot of people”.

A definition we deem more useful to guide the reader through the rest of the article is the following: structural reforms are those reforms that alter the income distribution in the economy. Thinking of structural reforms this way help us to “neutralize” the issue, eluding positive or negative connotations. However it also puts the term under a more complex light and essentially brings it down from the realm of economics to that of politics.

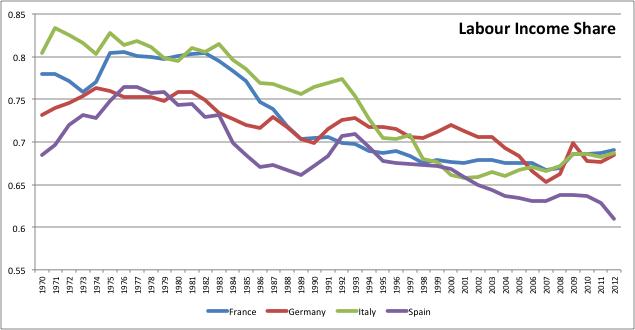

It may sound surprising nowadays but in the 60s and 70s Trade Unions’ leaders were vocal supporters of structural reforms. In the words of Luciano Lama (ex Secretary General of the Italian CGIL), structural reforms should fortify bargaining powers of workers to enable them to extract a bigger share of national income. Since the 80s structural reforms have instead been more and more associated with deregulation and liberalization efforts. The effects of these two mirror-opposite types of reforms can be observed in graph 1.

The 80s marked a radical turn in economic policy across Europe, characterised by a focus on inflation reduction, labour market flexibility and greater emphasis on competition in product and services markets. The outcome has been a weakened position of workers who saw their share of national income invariably reduced, compared to the 70s, to the advantage of the “capital” (or “profit”) share, which is the other component of the national income.

The rationale behind such reforms is that – in theory – by increasing the rate of return on investments (ie. the profit of the capital owners), more investments would be attracted. This in turn would spur growth and employment creation. Another important argument in support of these reforms has been put forward for the Member States of the Eurozone. By allowing greater downward flexibility of wages, countries with trade deficits may regain price competitiveness previously achieved through currency depreciation – a process that makes the Eurozone very similar to the Gold Standard. This should in turn shift resources from non-tradable to tradable sectors, incidentally changing the “structure” of the economy.

To sum up: economic theory and economic policies in the EU have been devoted for the good part of the past thirty years to boost economic growth through a mix of liberalization and deregulation reforms which have reduced the share of national income going to labour and increased that going to capital owners. The Eurozone has also used labour market flexibility as a substitute to currency fluctuation.

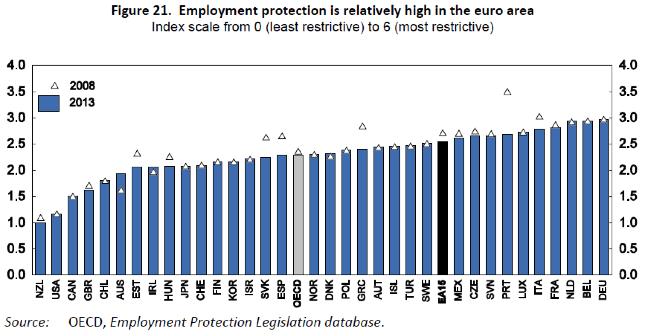

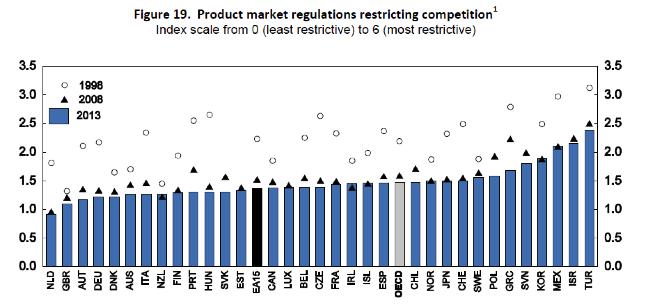

So what about the real world: is there a connection between the extent of these reforms and economic performances? In order to see where each country stands in relation to this reform agenda, the OECD has created a series of indicators. Graph 2 and 3 present the main ones: the Employment Protection Legislation (EPL) and the Product Market Regulation (PMR). The first compares countries on their degree of labour market liberalization: the lower the indicator, the lower is employment protection, the higher is the degree of flexibility. The second compares market structures across countries, looking at the presence of barriers to competition, administrative burden, red tape etc.

By observing these indicators two things are worth underlying. The first is that there does not seem to be any one-to-one correlation between the reforms undertaken and how countries have been faring since the crisis. In term of labour market flexibility for example Spain and Ireland are far more advanced along the reform path than Germany or Belgium. Yet both countries have suffered massively from the 2008 shock and still have double-digit unemployment rates. In terms of market regulation, Sweden and Poland are far more restrictive than Portugal and Italy but still managed to better withstand the crisis. The second interesting thing is that no country seems to have been idle. The movement is much more visible for the PMR index but to some extent also for the EPL, at least for some Member States notably Spain, Portugal, Italy, Greece.

Looking ahead, the European Commission and the Member States appear to still rely strongly on the potential of structural reforms to lift Europe out of its 7-years long crisis. They have been putting particular emphasis on labour market flexibility and product market liberalization. And they seem determined to commit to more of the same.

Whether this strategy will be successful or not is a hotly debated topic, too vast to be covered in this article. On one side of scale there are economists and policy makers who stress the adverse effects that this type of reforms have had on domestic demand and inequalities. According to some analysis, during a downturn, flexibility and liberalization actually make matters worse by triggering a domino effect: the failure of one sector spills over to the next, the reduction of wages further depresses demand. Higher unemployment and lower output is the outcome. On the other side of the scale, some important political leaders praise structural reforms as the most effective way to boost productivity and support the economic adjustment needed to bring about the recovery.

What is clear is that structural reforms, regardless of how one intends them, are politically loaded issues since they impact on the distribution of wealth in the economy and ultimately determine society’s “winners” and “losers”. Whatever their relevance and outcome may be, policy makers should ensure that these reforms are subject to democratic discussion and scrutiny. Legitimacy is the fundamental ingredient of any successful policy.